Cook County Property Tax Sale System

Trust-funded research has uncovered Cook County’s process for reclaiming tax-delinquent properties for market use – from annual tax sales to the last-ditch Scavenger Sale – is failing to live up to its potential to secure vacant, abandoned, and underutilized properties as assets in Black and Latine communities.

It is estimated that Cook County has more than 50,000 vacant and abandoned properties, most blighting already underinvested Black and Latine communities in the city and suburbs. Nearly 30,000 of these properties are languishing in the Scavenger Sale system.

-

61%

Percent

of Scavenger Sale properties are vacant lots.

-

9,000

Properties

in Chicago alone languish in the tax foreclosure system in any given year.

-

42.7%

Percent

of Scavenger Sale properties owe taxes exceeding half their market value.

The Challenge

Recognizing the potential of sparking neighborhood investment by reforming the Scavenger Sale, the Trust funded research to better understand the system and resources to make the complex and complicated proceed easier for community-minded developers to use.

A Landmark Study

A landmark 2021 study by the Center for Municipal Finance at the University of Chicago found the following:

- Scavenger Sale auctions are dominated by large institutions – many out-of-state – with relatively little participation by small buyers or community-based developers.

- Properties in the Scavenger system are highly concentrated geographically, with most of them in 10 communities scattered throughout western and southern Cook County.

- Most of the properties have little market value according to traditional measures. However, there are valuable properties in the system that are going unsold.

- The nearly 30,000 properties in the Scavenger system collectively represent roughly 3,500 acres with the potential to contribute to the welfare of their surrounding neighborhoods.

- Unlocking the potential of the Scavenger Sale will ultimately require a new approach to dealing with distressed properties experiencing severe tax delinquency.

Chicago Cityscape

Chicago Cityscape created a first-of-its-kind Scavenger Sale Portal to help people locate and evaluate the development and investment potential of the properties in the system.

DePaul University

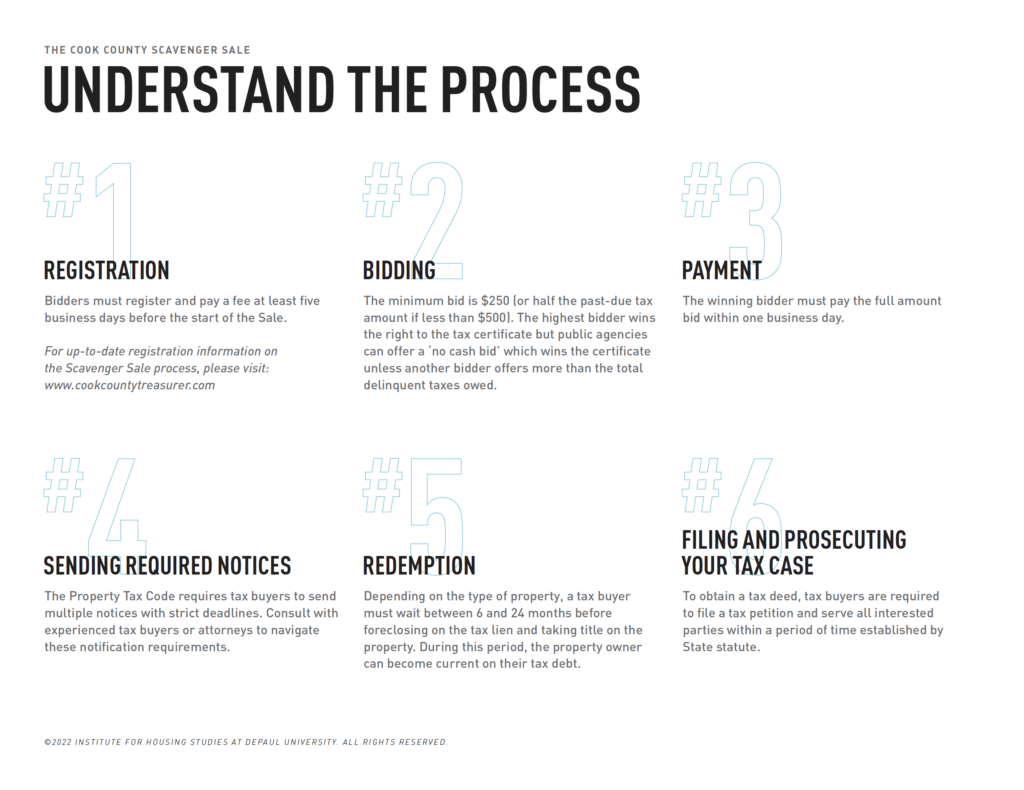

The Institute for Housing Studies at DePaul University created a comprehensive guide to help community groups, small-scale developers, neighborhood stakeholders, and others who want to navigate the Scavenger Sale process.

Building on this work, the Trust has expanded its focus to the overall Cook County Property Tax Sale System.

The Center for Municipal Finance analyzed tax-delinquency systems in 13 metro areas, which found that while excellent at collecting back taxes, these systems often fail at reselling the properties and getting them back on the market. The study also identified five best practices Cook County could replicate to improve our system.

- Offer assistance to homeowners for struggling homeowners, such as installment repayment or deferrals.

- Create a separate process for moving persistently delinquent or unsold properties from the traditional pipeline and into other options, such as land banks.

- Afford local authorities more discretion in deciding how best to address delinquent properties, such as directing properties from tax sales to alternative programs, delaying sale or foreclosure, or pursuing alternative forms of collection.

- Support smaller governments and coordinate the process to remove bottlenecks in zoning, permitting, and other processes, which often work at odds with one another.

- Utilize an integrated data collection system that consolidates property and land use information and allows stakeholders to identify at-risk properties before they become delinquent.

The Opportunity

Residents and organizations across Chicago’s South and West sides and Cook County’s south suburbs are actively trying to rebuild their communities plagued with high vacancies, blight, and disinvestment. In support of their goals, the Trust has convened multi-sector partners to identify and advance administrative and legislative reforms to the current Cook County property tax sale system.

SB2378/HB3040, in the Spring 2023 Illinois General Assembly, reforms the Illinois Property Tax Sale system to preserve incentives for property owners to pay their property taxes on time, but eliminates the loopholes driving properties into years of vacancy and disrepair. The legislative reforms allow communities to work with their local governments to turn vacant properties into opportunities for community investment, housing, and local wealth creation by giving counties the ability to intervene earlier if properties are not restored to the tax rolls after the first annual sale, restricts the use of the ‘Sale in Error’ loophole, and makes the biennial Cook County Scavenger Tax Sale optional.

To learn more about our work to reform the Illinois Property Tax Sale system or partner with us, please contact Ianna Kachoris, Senior Director of Policy and Advocacy, at ikachoris@cct.org.

Scavenger Sale Resources

-

Center for Municipal Finance | The University of Chicago

Comprehensive, Independent Analysis of Cook County Scavenger Sale -

Center for Municipal Finance | The Chicago Community Trust

Selling Distress: How Cook County’s Tax Foreclosure System Undermines Community Investment and Neighborhood Stabilization -

Institute for Housing Studies | DePaul University

This Is an Opportunity: The Cook County Scavenger Sale -

Chicago Cityscape

Search Scavenger Sale Properties

In the News

Cook County’s Scavenger Sale Is Meant To Fix Blighted Properties – But Advocates Say It Needs To Help Everyday Buyers, Not Hedge Funds

Block Club Chicago

Chicago Community Trust Partners with Chicago Cityscape to Create Auction Analyzation System

Chicago Association of Realtors

The 2022 scavenger sale results are in

Chicago Cityscape

Investors ‘Exploiting’ Illinois’ Property Tax Law at Expense of Black, Latino Communities: Study

WTTW Chicago

Catalyzing Neighborhood Investment

For our region to prosper, we need our Black and Latine communities to thrive, and that means safe neighborhoods with access to services that many take for granted—grocery stores, parks, transit systems, restaurants, and more.

Learn MoreWe Rise Together: For An Equitable & Just Recovery

We must act quickly and strategically to bend the curve of recovery toward equity. To do so, We Rise Together is focusing significant investments on long-underinvested Black and Latine communities whose success will transform the entire Chicago region.

Learn More